In the high-stakes world of Brazilian politics, few issues spark as much controversy and moral posturing as the debate over online casinos. Historically outlawed in Brazil, the industry has long operated in the shadows, thriving in offshore havens and unofficial gaming dens. But in recent years, a seismic shift in public and political discourse has brought the idea of legalizing online casinos—and taxing them—into the spotlight. Large casinos, such as Bet365, Parimatch, Betsson, and Betano, have already submitted applications for licensing. As Brazil grapples with economic uncertainty, populist parties are eyeing a potential jackpot: the so-called “sin tax” on gambling. But is there really any benefit to be gained? Or is this just another populist ploy to fatten the state’s coffers while exploiting vulnerable citizens?

A Brief History of Casinos in Brazil: From Prohibition to Underground Markets

Brazil has had a tumultuous relationship with gambling. In 1946, then-president Eurico Gaspar Dutra banned all forms of casino gambling in an effort to “protect public morality.” The ban, meant to curb vices, effectively pushed the industry underground and online, where Brazilians continued to gamble through foreign platforms that remain unregulated by Brazilian law.

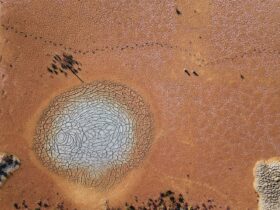

While lotteries and a few exceptions like horse racing remained legal, traditional casino gaming—roulette, blackjack, and poker—became forbidden fruits. Yet, the hunger for gambling didn’t vanish. In fact, online gambling thrived in a legal gray zone, with millions of Brazilians placing bets on foreign sites that contribute nothing to the local economy. It is estimated that Brazilians wager billions annually on offshore gambling platforms, creating a parallel economy that largely escapes any form of regulation or taxation.

The Populist Push: Sin Taxes as a Cash Grab

Fast forward to today, and the Brazilian economy is limping through a series of fiscal crises exacerbated by the COVID-19 pandemic. As the need for public funds grows more desperate, populist politicians—especially those from Brazil’s fringes—have seized on the idea of legalizing and taxing online casinos as a potential goldmine for state revenue. The notion of a “sin tax,” particularly one levied on activities like gambling or alcohol, offers a seemingly simple solution: legalize a controversial industry and funnel the proceeds into public welfare projects. Sounds perfect, right?

For populist parties, this is fertile ground for building electoral platforms. By promoting the legalization of online gambling, politicians are tapping into Brazil’s cultural fascination with luck and games of chance, while simultaneously promising economic benefits. Populists frame the casino tax as a way to “make the rich pay” since gambling, they argue, is a leisure activity primarily enjoyed by wealthier citizens. The narrative writes itself: funds collected from this vice tax can be redistributed to support social programs and infrastructure development.

But What’s the Catch?

While the populist rhetoric might sound appealing, the reality is far more complicated. Gambling addiction is not a phenomenon confined to the rich. In fact, lower-income populations are more likely to engage in problematic gambling behaviors, drawn in by the promise of a life-changing win. Legalizing online casinos without adequate social protections could create a Pandora’s box of problems: from soaring addiction rates to higher debt levels among Brazil’s most vulnerable.

Moreover, the projected revenue from casino taxes may not be the fiscal panacea that populists claim it to be. Look at other countries that have implemented similar measures: the actual revenue often falls short of initial forecasts, and the societal costs of gambling—such as increased need for addiction counseling and legal interventions—can quickly outweigh the benefits. It’s one thing to bring in more tax dollars, but it’s another to mitigate the societal harm that comes with encouraging a culture of gambling.

Populist Parties and the Promise of “Moral Neutrality”

The irony is that the same populist parties that often denounce moral decay and present themselves as defenders of traditional values are now pushing for the legalization of gambling—a move that was once considered morally indefensible. The way these politicians frame it, though, is clever: they position themselves as pragmatists, not moralists, who are willing to make tough decisions for the sake of economic recovery.

This sleight of hand allows populist leaders to maintain their traditional voter base while expanding their appeal to a broader electorate that sees gambling legalization as an economic opportunity. The sin tax becomes a tool of both populist governance and neoliberal fiscal policy—a way to keep government spending afloat without having to raise income taxes on the middle and working classes.

The Global Context: Is It Really a Win-Win?

Brazil is not alone in its debate over the benefits and dangers of legalizing online casinos. In fact, many countries have already tested the waters, with varying results. The United States, for instance, has legalized gambling in several states, but the benefits have been mixed. While tax revenue has flowed in, the social costs—addiction, bankruptcies, and broken families—have also increased. Europe presents another case, where countries like the UK and Spain have legalized and taxed online casinos. However, these countries also face issues like underage gambling and lax regulatory frameworks that allow harmful practices to continue unchecked.

Brazilian populists should take a hard look at these international examples before jumping into bed with the gambling industry. The promise of tax revenue is seductive, but the country must be prepared to handle the societal consequences. Gambling might be seen as a quick fix to the government’s fiscal woes, but without a robust regulatory framework, the nation could end up paying a much higher price.

So, What’s Next?

As Brazil heads into yet another election cycle, the issue of online casino legalization will undoubtedly continue to serve as a populist talking point. The allure of quick tax revenue is too strong for political parties to ignore, and the public is growing increasingly weary of Brazil’s economic struggles. But it’s worth asking: Is this really the best way to fill Brazil’s coffers? Or are populist parties simply gambling with the country’s future?

Brazil stands at a crossroads. The country can choose to legalize online gambling and implement a sin tax, hoping for an economic windfall. Or, it can take a more cautious approach, ensuring that any move toward legalization is paired with stringent regulations designed to protect its most vulnerable citizens. What’s certain is that the populist dream of a “quick win” through casino taxes might be nothing more than a pipe dream. And as with any bet, the stakes are higher than they seem.

Leave a Reply